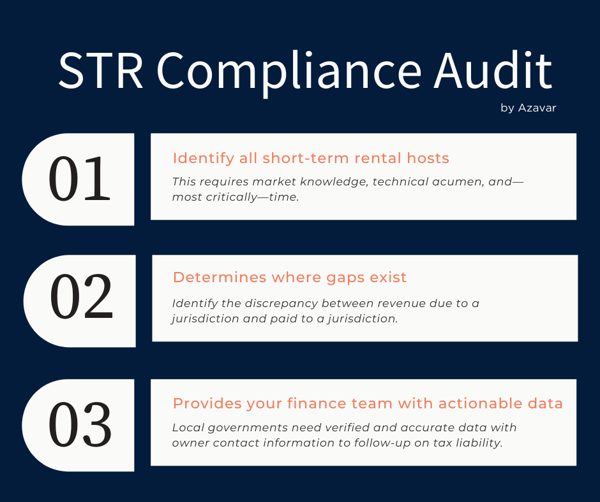

The key to a comprehensive vacation rental tax-compliance audit

When it comes to short-term rental administration, local governments need to accomplish several goals:

- Level the playing field between hosts and hotel/motel operators.

- Develop ordinances that address community concerns.

- Broaden the tax base and shore up civic finances.

- Identify all short-term rental hosts quickly and efficiently.

- Determines where gaps exist between revenue due a jurisdiction and paid to a jurisdiction.

- Provides a city's finance team with actionable data to go after lost revenue.

Sounds great, right? However, performing an in-depth tax-compliance audit for the short-term rental market can be a challenge for a municipality or county.

Like what you're reading? Check out this Short-Term Rental Host Compliance Guide

Common challenges in identifying short-term rentals

Short-term rental companies don’t turn over specific address data, reservation history, or other details due to privacy concerns.

Platforms such as Airbnb tell communities approximately where rentals are, but not exactly. This is very frustrating for local leaders. In fact, one customer in Washington has told our team that his method of identifying short-term rentals was to hop on his bike and ride around neighborhoods with a notepad. That's not scalable or sustainable.

Tax compliance audits combine market information, public data, and skilled insights

Unfortunately for local governments, there's no quick-fix solution. Compiling a complete picture of a community’s short-term rental industry requires market knowledge, technical acumen, and—most critically—time.

-2.jpeg?width=1000&name=AdobeStock_232438370%20(1)-2.jpeg)

Smart partners know how to ID short-term rentals

Skilled partners know how to find short-term rentals in your community

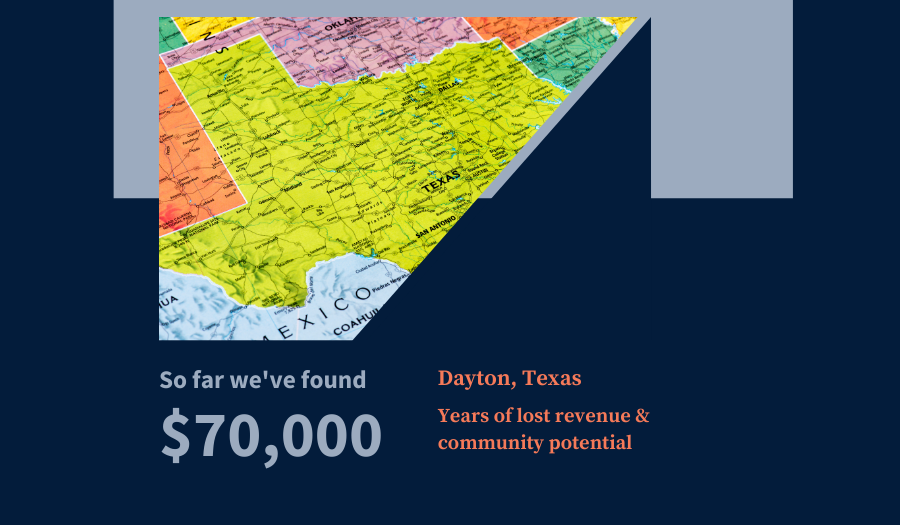

Every company has a different approach, but at Azavar, we’ve worked with communities across America to reveal the full picture. In hotspots such as Hudson, New York, we found dozens of properties in violation of the town's ordinance. In Quincy, Illinois, we found short-term rentals the city didn't even know about—Erie County, Ohio, too.

Partnering with a vendor for a short-term rental tax compliance audit can save time, minimize costs

Local governments are used to taking on new and complex challenges. But we know that our municipal customers are already stretched thin providing critical services to residents and businesses. There's little time to tax on a new big task like auditing your short-term rentals.

Our team at Azavar can apply our short-term rental ID system to your community—with no upfront costs. Our contingency-based fee model means that you don't pay unless we identify properties. It's the ultimate win-win situation.

Pinpoint short-term rentals—with Azavar's short-term rental host compliance audits

Let's talk about how our team at Azavar can apply our techniques for discovering short-term rental properties in your community. Once you fully understand the potential of your short-term rental market, we can help bring all hosts into compliance. As part of our total revenue discovery system, Azavar even offers Localgov Short-Term Rental Administration solution.

Schedule your meeting today and learn how discovering short-term rentals is just one of several steps in a community's journey to manage and monetize this growing sector.